|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | ||

Preliminary Proxy Statement | ||

☐ | ||

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

☒ | ||

Definitive Proxy Statement | ||

☐ | ||

Definitive Additional Materials | ||

☐ | ||

Soliciting Material Pursuant to Rule §240.14a-12 |

Cogint,

Fluent, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | ||||

No fee required. | ||||

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i) | |||

(1) | Title of each class of securities to which transaction applies: | |||

|

| |||

(2) | Aggregate number of securities to which transaction applies: | |||

|

| |||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

|

| |||

(4) | Proposed maximum aggregate value of | |||

|

| |||

(5) | Total fee paid: | |||

|

| |||

☐ | ||||

Fee paid previously with preliminary materials. | ||||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

|

| |||

(2) | Form, Schedule or Registration Statement No.: | |||

|

| |||

(3) | Filing Party: | |||

|

| |||

(4) | Date Filed: | |||

|

| |||

FLUENT, INC.

COGINT, INC.

2650 North Military Trail, Suite 300

Boca Raton, Florida 33431

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on June 13, 20173, 2020

To our Stockholders:

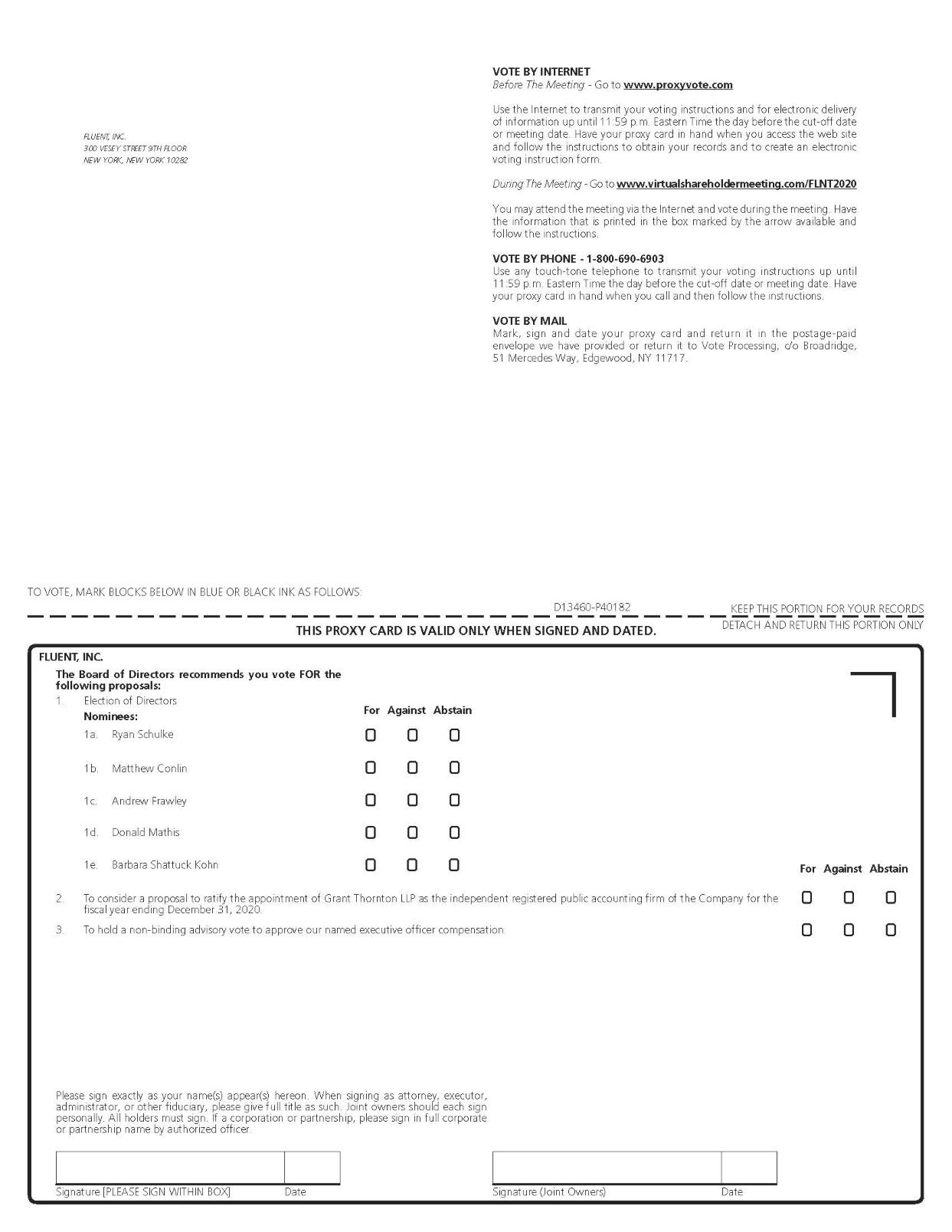

The Annual Meeting of Stockholders of Cogint,Fluent, Inc. (the “Company”) will be held on Tuesday,Wednesday, June 13, 20173, 2020 at 10:11:00 a.m., Eastern Time, at 2650 North Military Trail, Suite 300, Boca Raton, Florida 33431The Annual Meeting will be completely virtual. You may attend the meeting, submit questions, and vote your shares electronically during the meeting via live webcast by visiting www.virtualshareholdermeeting.com/FLNT2020. At the meeting you will be asked to consider and to vote on the following proposals:

(1) | To elect five directors to serve for a |

(2) | To ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2020; |

(3) | To hold a non-binding advisory vote to approve our named executive officers’ compensation; and |

(4) | To transact such other business as may properly come before the meeting or any adjournment or postponement of the meeting. |

The Board of Directors has fixed the close of business on April 18, 201724, 2020 as the record date for the determination of stockholders entitled to notice of and to vote at the annual meeting.

The enclosed proxy statement contains information pertaining to the matters to be voted on at the annual meeting. A copy of the Company’s Annual Report on Form10-K for the fiscal year ended December 31, 20162019 is being mailed with this proxy statement.

By order of the Board of Directors,

Daniel J Barsky, General Counsel and Corporate Secretary |

Michael Brauser

Executive Chairman

Boca Raton, FloridaNew York, New York

April 28, 201729, 2020

IMPORTANT NOTICE

REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 13, 20173, 2020

The accompanying proxy statement and the 20162019 Annual Report on Form10-K are available on the

Company’s website on the Investor Relations page athttp://www.cogint.comwww.proxyvote.com.

YOU ARE REQUESTED, REGARDLESS OF THE NUMBER OF SHARES OWNED, TO SIGN AND

DATE THE ENCLOSED PROXY AND TO MAIL IT PROMPTLY, OR TO USE THE INTERNET

VOTING SYSTEM SET FORTH IN THE PROXY.

COGINT,FLUENT, INC.

2650 North Military Trail, Suite 300 Vesey Street, 9th Floor

Boca Raton, Florida 33431New York, New York 10282

PROXY STATEMENT

Annual Meeting of Stockholders

To be held on June 13, 20173, 2020

General

We are providing these proxy materials in connection with the solicitation by the Board of Directors of Cogint,Fluent, Inc. (the “Board”) of proxies to be voted at our 20172020 Annual Meeting of Stockholders (the “Meeting”) and at any and all postponements or adjournments thereof. The Meeting will be held on Tuesday,Wednesday, June 13, 2017,3, 2020, at 10:11:00 a.m., Eastern Time, at 2650 North Military Trail, Suite 300, Boca Raton, Florida 33431. For directions to theTime. The Meeting please contact the Corporate Secretary at (561)757-4000.will be held virtually via live webcast, which you may attend by visiting www.virtualshareholdermeeting.com/FLNT2020. This proxy statement and the enclosed form of proxy are first being sent to stockholders on or about April 28, 2017.30, 2020. In this proxy statement, Cogint,Fluent, Inc. is referred to as “cogint,“Fluent,” the “Company,” “we,” “our,” or “us.”

The Meeting will be conducted as a virtual meeting of stockholders by means of a live webcast. Given the emerging public health impact of COVID-19, we believe that hosting a virtual meeting will support the health of our stockholders and employees and enable improved communication and greater stockholder attendance and participation from any location. There will not be a physical meeting location and you will not be able to attend in person.

If you are a registered shareholder or beneficial owner of common stock holding shares at the close of business on the record date, you may attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/FLNT2020 and logging in by entering the 16-digit control number found on your proxy card, voter instruction form, or other materials provided to you, as applicable. If you have lost your 16-digit control number or are not a shareholder, you will be able to attend the meeting by visiting www.virtualshareholdermeeting.com/FLNT2020 and registering as a guest. If you enter the meeting as a guest, you will not be able to vote your shares or submit questions during the meeting.

We invite you to virtually attend the Annual Meeting and request that you vote on the proposals described in this proxy statement. However, you do not need to attend the virtual meeting to vote your shares. Instead, you may vote by proxy, via the Internet, or by mail by following the instructions provided on the proxy card, and we encourage you to vote before the Annual Meeting.

Purpose of the Annual Meeting

At the Meeting, our stockholders will consider and vote upon the following matters:

(1) | To elect five directors to serve for a one year term until the |

(2) | To ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for year ending December 31, 2020 (“Ratification of Auditor Proposal”); |

(3) | To hold a non-binding advisory vote |

(4) | To transact such other business as may properly come before the |

Outstanding Securities and Voting Rights

Only holders of record of the Company’s common stock at the close of business on April 18, 2017,24, 2020, the record date for the Meeting, are entitled to notice of, and to vote at, the Meeting. On that date,As of April 24, 2020, we had 54,740,99876,230,968 shares of common stock outstanding. Each share of common stock is entitled to one vote at the Meeting. If your shares are registered in your name, you are a stockholder of record. If your shares are held in the name of your broker, bank or another holder of record, these shares are held in “street name.”

The holders of a majority of the issued and outstanding shares of common stock present at the Meeting, either in person or by proxy, and entitled to vote, constitute a quorum for the transaction of business. Abstentions and brokernon-voteswill be included in determining the presence of a quorum at the Meeting. A

If your shares are held in street name, you must instruct the organization who holds your shares how to vote your shares. If you sign your proxy card but do not provide instructions on how your brokernon-vote occurs when a nominee holding shares for a beneficial owner does not should vote on “routine” proposals, your broker will vote your shares as recommended by the Board. If you do not provide voting instructions, your shares will not be voted on any “non-routine” proposals. This vote is called a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner.“broker non-vote.” Under New York Stock Exchange (“NYSE”) rules, a broker does not have the discretion to vote on any of the proposals to benon-routine matter presented at the Meeting.meeting, such as the Election of Directors Proposal or the Say on Pay Proposal. Under the NYSE rules, a broker does have discretion to vote on the Ratification of Auditor Proposal. As a result, any broker who is a member of the New York Stock ExchangeNYSE will not have the discretion to vote on the proposals,Election of Directors Proposal or the Say on Pay Proposal, if such broker has not received instructions from the beneficial owner of the shares represented.

For the Election of Directors areProposal, a nominee for director will be elected by a plurality ofto the Board if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election. The Ratification of Auditor Proposal and the Say on Pay proposal is approvedProposal will be determined by of a majority of votes present in personcast affirmatively or by proxy at the Meetingnegatively. Abstentions and entitled to vote. A brokernon-vote non-votes will have no effect on the proposals. Abstentions will have no effect on Proposal 1 and will have the same effect as a vote against Proposal 2.

In connection with the Company’s acquisition of Fluent, LLC (“Fluent”) in December 2015 (the “Fluent Acquisition”), the Company entered into a Stockholders’ Agreement (the “Stockholders’ Agreement”), with the selling stockholders of Fluent (“Sellers”) and Frost Gamma Investment Trust (“Frost Gamma”), Marlin Capital

1

Investments, LLC (“Marlin Capital”), and certain other stockholders of the Company, solely in their respective capacities as stockholders, pursuant to which the parties agreed to vote in a certain manner on specified matters, including the agreement to vote in favor of each party’s duly approved nominees for the Company’s Board. In the aggregate, stockholders representing approximately 35,306,430 shares of the Company’s common stock or 64.2% have entered into the Stockholders’ Agreement.

Proxy Voting

Shares for which proxy cards are properly executed and returned will be voted at the Meeting in accordance with the directions given or, in the absence of directions, will be voted “FOR” Proposal 1 — electionthe Election of the nine nominees for director named hereinandDirectors Proposal, “FOR”

Proposal 2 — approvalthe Ratification of Auditor Proposal and “FOR” Proposal 3 — the Say on Pay.Pay Proposal. If other matters are properly presented, the person named in the proxies in the accompanying proxy card will vote in accordance with their discretion with respect to such matters.

Voting by Stockholders of Record.

If you are a stockholder of record (your shares are registered directly in your name with our transfer agent), you may vote by proxy, via the Internet, or by mail by following the instructions provided on the proxy card. Stockholders of record whoalso may attend the Meeting mayvirtual meeting and vote in person by obtaining a ballot from the inspector of elections. Please be prepared to present photo identification for admittance to the Meeting.electronically.

Voting by Beneficial Owners.

If you are a beneficial owner of shares (your shares are held in the name of a brokerage firm, bank, or other nominee), you may vote by following the instructions provided in the voting instruction form, or other materials provided to you by the brokerage firm, bank, or other nominee that holds your shares. To vote in person at the Meeting, you must obtain a legal proxy from the brokerage firm, bank, or other nominee that holds your shares, and present such legal proxy from the brokerage firm, bank, or other nominee that holds your shares for admittance to the Meeting. Also, be prepared to present photo identification for admittance to the Meeting.

Changing Your Vote.

You may revoke your proxy and change your vote at any time before the final vote at the Meeting. You may vote again on a later date via the Internet (only your latest Internet proxy submitted prior to the meetingMeeting will be counted), by signing and returning a new proxy card with a later date, or by attending the Meetingvirtual meeting and voting in person.electronically. Your attendance at the Meetingvirtual meeting will not automatically revoke your proxy unless you vote again at the Meeting or specifically request in writing that your prior proxy be revoked.

All votes will be tabulated by an Inspector of Elections appointed for the Meeting, who will separately tabulate affirmative and negative votes, abstentions and brokernon-votes. Joshua Weingard Daniel Barsky, the Company’s General Counsel and Corporate Secretary, has been appointed by the Board as Inspector of Elections for the Meeting. A list of the stockholders entitled to vote at the Meeting will be availableaccessible on the virtual meeting website during the meeting for those attending the meeting, and for ten days prior to the meeting, at the Company’s executive office, located at 2650 North Military Trail, Suite 300 Boca Raton, Florida 33431,Vesey Street, 9th Floor, New York, New York 10282.

Interest of the Company’s Officers and Directors in the Matters to be Acted Upon at the Meeting.

Members of the Board have an interest in the Election of Directors Proposal, as each of the nominees is currently a member of the Board. Members of the Board and executive officers of the Company do not have any interest in the Ratification of Auditor Proposal. Executive officers of the Company do have an interest in the Say on Pay Proposal, to the extent such proposals are on a non-binding advisory basis.

Where to Obtain More Information

If you have any questions about how to cast your vote for a period of ten (10) days before the Meeting or would like copies of any of the documents referred to in this Proxy Statement, you should write to us at 300 Vesey Street, 9th Floor, New York, NY 10282, Attn: Daniel J. Barsky, General Counsel and will be available for examination by any stockholder.

2

ProposalPROPOSAL 1

ELECTION OF DIRECTORS

We are

At the Meeting, we will be electing nine (9) directors at the Meeting.five directors. Each director will hold office until our next annual meetingthe 2021 Annual Meeting of Stockholders or until a successor is elected and qualified to serve on the Board. Proxies cannot be voted for a greater number of persons than the number of nominees named.

The Board has nominated the ninefive individuals listed below (each a “Nominee”“Nominee,” and together the “Nominees”) based on the recommendation of the Board’s Corporate Governance and Nominating Committee (the “Nominating Committee”). Messrs. Schulke and Mathis have been nominated pursuant toCommittee. All of the Stockholders’ Agreement, which allows Sellers to nominate two nominees to the Board, as further discussed in the section of this proxy statement titled “Nominees for Director and Other Stockholder Proposals.”Nominees are current directors. Each Nominee is a current director who has been nominated forre-election at the Meeting, and each Nominee has consented to bebeing named in this proxy statement and has agreed to serve as a director if elected. If any Nominee should become unavailable for election, the proxy may be voted for a substitute nominee selected by the persons named in the proxy or the Board may determine to reduce the size of the Board may be reduced accordingly. The Board is not aware of any existing circumstances likely to render any Nominee unavailable. Under our Bylaws, Nominees are elected by a plurality of votes cast.

The following table sets forth certain information concerning our directors/Nominees:

Name | Position | Director Since | ||||

| ||||||

| ||||||

| ||||||

Ryan Schulke | Director and | 2015 | ||||

| Director and President | 2018 | ||||

Andrew Frawley | Director | 2018 | ||||

| Barbara Shattuck Kohn | Director | |||||

| 2019 | |||||

Donald Mathis | Director | |||||

| ||||||

| ||||||

Biographical Information About Our Nominees

Mr. Michael Brauser, 61, has served as a director of the Company and our Executive Chairman since June 2015. Since 2003, Mr. Brauser has been the manager of, and an investor with, Marlin Capital Partners, LLC, a private investment company. From 1999 to 2002, he served as president and chief executive officer of Naviant, Inc. (eDirect, Inc.), an internet marketing company. He also was a founder of Seisint, Inc. (eData.com, Inc.). Mr. Brauser served asco-chairman of the board of directors of InterCLICK (now a part of Yahoo Inc.), from August 2007 to December 2011. Mr. Brauser also served asco-chairman of the board of directors of ChromaDex Corp., an innovative natural products company, from October 2011 to February 2015. The Nominating Committee believes that Mr. Brauser’s experience as a director on various public company boards of directors and as a manager of an investment company brings extensive business and management expertise to the Board.

Dr. Phillip Frost, 80, has served as Vice Chairman of the Board of the Company since December 2015. Since March 2007, Dr. Frost has served as chairman of the board and chief executive officer of OPKO Health, Inc. (“OPKO”), a multi-national biopharmaceutical and diagnostics company. Dr. Frost has served as chairman of the board of directors of Ladenburg Thalmann Financial Services Inc. (“Ladenburg Thalmann”), an investment banking, asset management, and securities brokerage firm, since July 2006. He also served as a member of the board of directors of Ladenburg Thalmann from May 2001 until July 2002 and again from March 2004 until June 2006. Since October 2008, Dr. Frost has served as a director of Castle Brands Inc., a developer and marketer of premium brand spirits. Dr. Frost also serves as a director of Cocrystal Pharma, Inc., a publicly traded biotechnology company developing new treatments for viral diseases, and Sevion Therapeutics, Inc., a clinical stage company which discovers and develops next-generation biologics for the treatment of cancer and immunological diseases. He also serves as a member of the Florida Council of 100 and as a trustee for each of

3

the University of Miami, the Miami Jewish Home for the Aged and the Mount Sinai Medical Center. From 1972 to 1990, Dr. Frost was the chairman of the Department of Dermatology at Mt. Sinai Medical Center of Greater Miami, Miami Beach, Florida. Dr. Frost served as a director of Teva Pharmaceutical Industries Ltd., a pharmaceutical company, from January 2006 until February 2015, and also served as chairman of the board of directors of Teva from March 2010 until December 2014 and served as vice chairman of the board of directors from January 2006 when Teva acquired IVAX Corporation (“IVAX”) until March 2010. Dr. Frost was chairman of the board of directors of Key Pharmaceuticals, Inc. from 1972 until its acquisition by Schering Plough Corporation in 1986 and served as chairman of the board of directors and chief executive officer of IVAX from 1987 to January 2006. Dr. Frost previously served as a director of Northrop Grumman Corp., Continucare Corp. (until its merger with Metropolitan Health Networks, Inc.), PROLOR Biotech, Inc. (until it was acquired by OPKO) and TransEnterix, Inc., and as governor andco-vice-chairman of the American Stock Exchange (now NYSE MKT). The Nominating Committee believes that Dr. Frost’s pertinent experience, qualifications, attributes, and skills include financial literacy and expertise, executive-level managerial experience, and the knowledge and experience he has attained through his service as a director and officer of publicly-traded corporations.

Mr. Derek Dubner, 45, has served as a member of the Board since March 2015, and presently serves as the Chief Executive Officer and Interim President, as well as Chief Executive Officer of Interactive Data, a Company subsidiary. Mr. Dubner served as ourCo-Chief Executive Officer from March 2015 until March 2016, when he was appointed our Chief Executive Officer. Mr. Dubner has over 17 years of experience in the data fusion industry. Mr. Dubner has served as the Chief Executive Officer of Company subsidiary The Best One, Inc. (“TBO”), and its subsidiary, Interactive Data, since October 2014. Prior to TBO, Mr. Dubner served as General Counsel of TransUnion Risk and Alternative Data Solutions, Inc. from December 2013 to June 2014. Mr. Dubner served as General Counsel and Secretary of TLO, LLC from inception in 2009 through December 2013. The Nominating Committee believes Mr. Dubner’s experience as Chief Executive Officer of the Company provides valuable business, industry, and management advice to the Board.

Mr.Ryan Schulke, 34,37, has served as a director of the Company since December 2015 and has served as the Chief Executive Officer of the Company subsidiarysince March 26, 2018. Mr. Schulke co-founded Fluent, LLC since the Fluent Acquisition in December 2015. Mr. Schulke was aco-founder of Fluent, Inc. in 2010 and has served as Chairman and Chief Executive Officer of Fluent, LLC since its inception. Before merging with the Company in 2015, Fluent, LLC was privately held. Fluent, LLC is now a leader in people-based digital marketing and customer acquisition.wholly-owned subsidiary of the Company. Prior to founding Fluent, LLC, Mr. Schulke served as Media Director of Clash Media, a global digital advertising network. Mr. Schulke earned a Bachelor of Communications Arts from Marymont Manhattan College.

The Nominating CommitteeBoard believes Mr. Schulke’s experience as Chief Executive Officer of Fluent, LLC, the Company’s largestoperating subsidiary, provides valuable business, industry, and management advice to the Board.

Mr. Peter BenzMatthew Conlin, 56,36, has served as a director and President of the Company since March 2015.26, 2018. Together with Mr. Benz is the Chief Executive Officer of Viking Asset Management,Schulke, Mr. Conlin co-founded Fluent, LLC an assetin 2010 and investment management company which he founded in 2001. Since June 2016, Mr. Benz has served as a directorPresident of Lilis Energy Inc., an onshore oil and natural gas exploration and production company. From January 2012 untilFluent, LLC since its merger with Lilis Energy Inc. in June 2016,inception. Before founding Fluent, LLC, Mr. BenzConlin served as Sales Director, U.S. of Clash Media, a directorglobal digital advertising network. Mr. Conlin earned a Bachelor of Brushy Resources, Inc. (formerly known as Starboard Resources, Inc.), an onshore oil and natural gas exploration and production company, and became its Chairman on November 24, 2015. Mr. Benz has also served as a director of Usell.com, a technology based online market place, since October 2014 and as a director and Chairman of theScience in Marketing from St. John’s University.

The Board of Optex Systems, Inc., a manufacturer of optical systems for the defense industry since November 2014. The Nominating Committee believes Mr. Benz’s knowledgeConlin’s experience as President of Fluent, LLC, the Company’s operating subsidiary, provides valuable business, industry, and experience in developing companies and capital markets strengthenmanagement advice to the Board’s collective qualifications, skills, and experience.Board.

Mr. Robert FriedAndrew Frawley, 57, has served as a director of the Company since October 2009. From August 2011 through May 2015,March 26, 2018. Mr. Fried served as Chairman of the Board and wasCo-Chairman of the Board from October 2009 through August 2011. Mr. Fried served as the President and Chief Executive Officer and a member of the Board of the Company while it was a “special purpose acquisition company,” Ideation Acquisition Corp.

4

(“Ideation”), from November 2007 to October 2009. Mr. Fried is the founder and Chief Executive Officer of Feeln, a subscription streaming video service acquired by Hallmark Cards, Inc., in 2012. Mr. Fried also operates several Hallmark Cards’ digital businesses includinge-cards and personalized digital cards. Mr. Fried is an Academy Award winning motion picture producer whose credits include Rudy, Collateral, Boondock Saints, So I Married an Axe Murderer, Godzilla, and numerous others. From December 1994 until June 1996, Mr. Fried was President and Chief Executive Officer of Savoy Pictures, a unit of Savoy Pictures Entertainment, Inc. Savoy Pictures Entertainment was sold to Silver King Communications, which is now a part of InterActive Corp, in 1996. From 1983 to 1990, Mr. Fried held several executive positions including Executive Vice President in charge of Production for Columbia Pictures, Director of Film Finance and Special Projects for Columbia Pictures and Director of Business Development at Twentieth Century Fox. Mr. FriedFrawley has served as a director of Nasdaq listed ChromaDex Corp.Curo Group Holdings Corp since its initial public offering in December 2017. Mr. Frawley has also served as the chief executive officer of AJ Frawley & Associates LLC since 2002 and as Chief Executive Officer and Vice Chairman of the Board of V12 Data since July 20152018. From December 2014 to September 2016, Mr. Frawley served as chief executive officer of Epsilon, a segment of Alliance Data Systems Corporation. Prior to that, he served as Epsilon’s President from January 2012 to December 2014 and Presidentas its president of Marketing Technology from January 2009 to December 2011. Mr. Frawley has also served on the board of directors of the Data & Marketing Association since 2016, and Chief Strategy Officerhas been the chairman of the board of directors of Cybba Inc., a privately held company, since MarchSeptember 2017. Mr. Fried alsoFrawley earned a Master of Business Administration from Babson College and a Bachelor of Science in Finance from The University of Maine.

The Board believes Mr. Frawley’s knowledge and experience in data-driven marketing and business management strengthen the Board’s collective qualifications, skills, and experience.

Barbara Shattuck Kohn, 69, was a Principal at Hammond Hanlon Camp LLC, a strategic advisory and investment banking firm from 2012 to 2018. She has served as a director of Penn National Gaming, Inc. since 2004, where she serves as a member of the Audit Committee and as Chair of the Compensation Committee and Nominating and Corporate Governance CommitteeCommittee. Ms. Shattuck Kohn also serves as a director of ChromaDexEmblem Health, one of the nation's largest nonprofit health plans. She has previously served as a director of Computer Task Group and a division of Sunlife Financial Corporation. Prior to joining Hammond Hanlon Camp LLC in 2012, Ms. Shattuck Kohn was a Managing Director of Morgan Keegan – Raymond James. Morgan Keegan & Company, Inc. was acquired by Raymond James Financial from Regions Financial Corp. from July 2015and was the successor to March 2017. Shattuck Hammond Partners, an investment banking firm Ms. Shattuck Kohn co-founded in 1993. Prior to 1993, she spent 11 years at Cain Brothers, Shattuck & Company, Inc., an investment banking firm she also co-founded. From 1976 to 1982, she was a Vice President of Goldman, Sachs & Co. Ms. Shattuck Kohn began her career as a municipal bond analyst at Standard & Poor's Corporation.

The Nominating CommitteeBoard believes Mr. Fried’sMs. Shattuck Kohn’s significant financial expertise and experience as an executivea director of severalother public companies provides valuable business, leadershipstrengthen the Board’s collective qualifications, skills, and management advice to the Board in many critical areas.experience.

Mr.Donald Mathis, 51,54, has served as director of the Company since December 2015. Since July 2017, Mr. Mathis is currentlyhas been the Chairmangeneral manager of Growth at Comcast NBC Universal. Since April 2017, he has been the chief executive officer and Chief Executive Officerco-founder of Echelon AI, (“Echelon”), aNY-based New York-based privately held Artificial Intelligenceartificial intelligence start-up focused on business process automation, predictive data analytics and nextgen digital and cyber security. Mr. Mathis joined Echelon in April 2017. He is also an Operating Partneroperating partner with Periscope Equity, a Chicago-based growth private equity fund, which he joined in January 2017. In addition, Mr. Mathis has served as a Senior Advisersenior adviser and Directordirector since April 2016 of the initiative for Digital Counterterrorism (iDCT), a public-private consortium andnon-governmental organization focused on countering violent extremism and terrorist recruitment in the digital domain. Mr. Mathis has served since 2013 on the Boardboard of Advisersadvisers of Omniangle Technologies, a privately held company involved in business intelligence and information security. Previously, Mr. Mathis served as the Chief Executive Officerchief executive officer of privately held Kinetic Social from October 2011 through April 2016. Mr. Mathis was aco-founder of Kinetic Social, a SaaS and managed service social data and technology company acquired by Blue Chip Venture Company. From 2007 to 2011, Mr. Mathis served as Executive Chairmanexecutive chairman and Directordirector of Online Intelligence, a privately held digital security firm specializing in brand protection and traffic integrity services. Mr. Mathis was on the audit and compensation committees of Online Intelligence until its acquisition by FAS Labs, Inc. in May 2010, and remained Executive Chairmanexecutive chairman until November 2011. Mr. Mathis has an MBAa Master of Business Administration from the Harvard Business School and is a Commander in the U.S. Navy (currently inactive reserve).

The Nominating CommitteeBoard believes Mr. Mathis’ knowledge and experience as Chairmanchairman and CEOchief executive officer of an artificial intelligence company with a specialty in predictive data analytics, his experience running a social data and technology SaaS and managed services company, as well as his experience in business intelligence, general management, financial management and information security, and his military service, strengthen the Board’s collective qualifications, skills, and experience.

Mr. Steven Rubin, 56, has served as a director of the Company since October 2009. Mr. Rubin has served as the Executive Vice President of OPKO since May 2007 and a director of OPKO since February 2007. Mr. Rubin currently serves on the board of directors of ChromaDex Corp., an innovator of proprietary health, wellness and nutritional ingredients that creates science-based solutions for dietary supplement, food and beverage, skin care, sports nutrition, and pharmaceutical products, since March 2017, VBI Vaccines, Inc., formerly SciVac Therapeutics, Inc., a commercial-stage biopharmaceutical which develops, produces and markets biological products for human healthcare in Israel, since October 2012, Kidville, Inc., which operates large, upscale facilities, catering to newborns throughfive-year-old children and their families and offers a wide range of developmental classes for newborns to five-year-olds, since August 2008,Non-Invasive Monitoring Systems, Inc., a medical device company, since 2008, Cocrystal Pharma, Inc., formerly Biozone Pharmaceuticals, Inc., a publicly traded biotechnology company developing new treatments for viral diseases, since January 2014, Sevion Therapeutics, Inc., a clinical stage company which discovers and develops next-generation biologics for the treatment of cancer and immunological diseases, since May 2014, Castle Brands, Inc., a developer and marketer of premium brand spirits, since January 2009, and Neovasc, Inc., a company

5

developing and marketing medical specialty vascular devices, since 2008. Mr. Rubin previously served as a director of Dreams, Inc., a vertically integrated sports licensing and products company, from 2006 to 2012, Safestitch Medical, Inc. from September 2007 until its merger with TransEnterix, Inc. in September 2013, Tiger X Medical, Inc. from September 2008 until its merger with BioCardia, Inc. in October 2016, and PROLOR Biotech, Inc., from February 2008 until its acquisition by OPKO in August 2013. Mr. Rubin served as the Senior Vice President, General Counsel and Secretary of IVAX from August 2001 until September 2006. Mr. Rubin served as the Secretary of Ideation from June 2007 to October 2009. The Nominating Committee believes Mr. Rubin’s legal experience, managerial experience, and the knowledge and insight he has attained through his service as a director and officer of several publicly-traded corporations provides valuable business leadership, and management advice to the Board.

Mr. Robert Swayman, 62, has served as a director of the Company since June 2015. From 1998 to 2014, Mr. Swayman served as President and Chief Executive Officer of National Alarm Systems, Inc., a company he founded in 1998, prior to its sale in January 2014. From January 2014 through February 2015, Mr. Swayman served as General Manager of ASG Security, which acquired National Alarm Systems. Mr. Swayman served as a director of Vapor Corp., a U.S.-based distributor and retailer of vaporizers,e-liquids and electronic cigarettes, from March 4, 2015 to April 17, 2015, and as an employee of Vapor Corp. since April 17, 2015 providing financial and business advice. Mr. Swayman is a Certified Public Accountant and holds a B.S. degree in accounting from the State University of New York at Buffalo. The Nominating Committee believes Mr. Swayman’s experience as President and Chief Executive Officer of National Alarm Systems, Inc., from 1998 to 2014, as well as his experience as a Certified Public Accountant provides valuable business, leadership, and management advice to the Board.

Vote Required and Board Recommendation

Nominees are

Under our Bylaws, a nominee for director will be elected byto the Board if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election; abstentions and broker non-votes not counted as a pluralityvote cast either “for” or “against” that nominee’s election and therefore have no effect.

The Board approved and adopted a Director Resignation Policy on February 13, 2019 for directors who fail to receive the required number of votes castin an uncontested election in accordance with our Bylaws. The policy requires that the Board will nominate for election or re-election only a candidate who agrees to tender an irrevocable resignation that will be effective upon (i) the failure to receive the required vote at any future annual meeting at which he or she faces re-election; and (ii) Board acceptance of such resignation. The policy further states that upon any candidate failing to be elected in an election at which majority voting applies, the Nominating and Corporate Governance Committee will meet to consider the tendered resignation and make a recommendation to the Board concerning the action, if any, to be taken with respect to the resignation. The policy provides that the Board will then consider and act upon the Nominating and Corporate Governance Committee’s recommendation within 90 days of certification of the vote at the Meeting.annual meeting. The Board may accept the resignation, refuse the resignation, or refuse the resignation subject to such conditions designed to cure the underlying cause as the Board may impose. Promptly following the decision regarding the tendered resignation, the policy states that we will file with the SEC a current report on Form 8-K disclosing the decision with respect to the resignation, describing the deliberative process and, if applicable, the specific reasons for rejecting the tendered resignation.

The Board unanimously recommends a vote “FOR” each Nominee for director.

Director Compensation

On March 26, 2018, the Company completed the spin-off (the "Spin-off") of its risk management business from its digital marketing business by way of a pro rata distribution of all the shares of common stock of the Company's wholly-owned subsidiary, Red Violet, Inc. ("Red Violet"), to the Company's stockholders of record as of March 19, 2018 and certain warrant holders.

Following the Spin-off, we reconstituted our Board and adopted the following general director compensation practices. When anon-employee director joins the Board, suchthe non-employee director is granted 25,000 restricted stock units (“RSUs”), whichRSUs. These RSUs vest in three equal annual installments beginning on the first anniversary of the grant date. Following her appointment to the Board on December 9, 2019, Ms. Shattuck Kohn was granted 25,000 RSUs. Additionally, each Audit Committee member is granted an additional 5,000 RSUs, all of which vest on the one year anniversary of the grant date, andnon-employee directors are paid quarterly $10,000 plus $2,500 for the Chairman of the Audit Committee is(during 2019, Mr. Benz) and $1,250 to the Chairmen of each of the Compensation Committee (Mr. Mathis) and the Corporate Governance and Nominating Committee (Mr. Frawley).

Additionally, on the date of each annual meeting, non-employee directors will be granted an additional 5,000the number of RSUs whichrepresenting shares of the Company’s common stock with a grant date value equal to $75,000. The RSUs vest in three equal annual installments beginning on theone-year first anniversary of the grant date. Additional equity awards may be granteddate, subject to directors ataccelerated vesting in certain circumstances. The number of RSUs is determined using the directionaverage closing price of our common stock on the five trading days before the annual meeting.

DIRECTOR COMPENSATION TABLE

Name | Stock awards (1)(6) | Other compensation | Total | |||||||||

Current Directors | ||||||||||||

Andrew Frawley (2) | $ | 150,000 | $ | 45,000 | $ | 195,000 | ||||||

| Barbara Shattuck Kohn (3) | $ | 52,750 | $ | 2,500 | $ | 55,250 | ||||||

Donald Mathis (4) | $ | 150,000 | $ | 45,000 | $ | 195,000 | ||||||

Former Directors | ||||||||||||

Peter Benz (5) | $ | 150,000 | $ | 50,000 | $ | 200,000 | ||||||

(1) | The amounts in this column represent the aggregate grant date fair value of RSU awards granted in 2019 computed in accordance with FASB ASC Topic 718. In determining the grant date fair value for RSUs, the Company used the closing price of the Company’s common stock on the grant date. For a discussion of valuation assumptions used in calculation of these amounts, see Note 13 to our audited financial statements, included within our 2019 Annual Report on Form 10-K. |

(2) | Mr. Frawley was granted 26,596 RSUs at a fair value of $2.80 and 15,226 RSUs at a fair value of $4.93 on December 6, 2019 for his services as director. Mr. Frawley also received compensation of $45,000 in 2019 ($40,000 was for his services as a director and $5,000 was for his services as the Chairman of the Corporate Governance and Nominating Committee). |

| (3) | Ms. Shattuck Kohn was granted 25,000 RSUs on December 9, 2019 at a fair value of $2.11 in connection with her appointment to the Board. | |

(4) | Mr. Mathis was granted 26,596 RSUs at a fair value of $2.80 and 15,226 RSUs at a fair value of $4.93 on December 6, 2019 for his services as director. Mr. Mathis also received compensation of $45,000 in 2019 ($40,000 was for his services as a director and $5,000 was for his services as the Chairman of the Compensation Committee). | |

| (5) | Mr. Benz was granted 26,596 RSUs at a fair value of $2.80 and 15,226 RSUs at a fair value of $4.93 on December 6, 2019 for his services as director. Mr. Benz also received compensation of $50,000 in 2019 ($40,000 was for his services as a director and $10,000 was for his services as the Chairman of the Audit Committee). Mr. Benz resigned from the Company's Board of Directors effective April 1, 2020. |

(6) | As of December 31, 2019, each director held RSUs as follows: Mr. Frawley – 49,623, Ms. Shattuck Kohn – 25,000, Mr. Mathis – 49,623, Mr. Benz – 49,623. |

Compensation Committee based on an individual director’s contributions to the Company. No director received RSUsInterlocks and Insider Participation

The members of our Compensation Committee during 2016. As of December 31, 2016, the aggregate number of shares of common stock subject to stock awards held by each director who was not a named executive officer for the year ended December 31, 2016 is as follows: Dr. Frost — 3,000,000; Mr. Schulke — 550,000; Mr.2019, were Donald Mathis (Chairman), Peter Benz, — 21,666; Mr. Fried — 53,333; Mr. Mathis — 30,000; Mr. Rubin — 150,000;Andrew Frawley and Mr. Swayman — 21,666. AsBarbara Shattuck Kohn. No member of December 31, 2016, the aggregate number of shares of common stock subject to option awards held by each director who was not a named executive officer for the year ended December 31, 2016 is as follows: Dr. Frost — 0; Mr. Schulke — 0; Mr. Benz — 0; Mr. Fried — 32,000; Mr. Mathis — 0; Mr. Rubin — 32,000; and Mr. Swayman — 0.

Additionally, on April 13, 2017, thenon-employee directors received the following RSU grants in connection with their service on the Board: Dr. Frost — 50,000; Mr. Benz — 15,000; Mr. Fried — 15,000; Mr. Mathis — 15,000; Mr. Rubin — 20,000; and Mr. Swayman — 15,000. These RSUs vest in three approximately equal installments on June 1, 2017, 2018 and 2019, subject to accelerated vesting under certain conditions.

Also on April 13, 2017, Board committee members received the following RSU grants: Mr. Benz — 5,000 in connection with his service as Audit Committee Chairman and 5,000 in connection with his service as an

6

Audit Committee member; Mr. Rubin — 5,000 in connection with his service as Compensation Committee Chairman; Mr. Swayman — 5,000 in connection with his service as an Auditis a current or former officer or employee of ours or any of our subsidiaries. None of the members of our Compensation Committee member;had any relationship required to be disclosed under this caption under the rules of the Securities and Mr. Mathis — 5,000 in connection with his service as an Audit Committee member. These RSUs vest on January 1, 2018, subject to accelerated vesting under certain conditions.Exchange Commission (the “SEC”).

Board Meetings; Annual Meeting Attendance; Independence

The Board oversees our business and affairs and monitors the performance of management. The Board met regularly during the year ended December 31, 2016 and continues to meetmeets regularly to review matters affecting our Company and to act on matters requiring Board approval. The Board also holds special meetings whenever circumstances require and may act by unanimous written consent. During 2016,2019, the Board held threefive meetings and took action by unanimous written consent on eightfive occasions. AllDuring 2019, all of our incumbent directors attended at least 75% of ourthe meetings held in person or by proxy.of the Board and its committees on which they served during the period of time that each such director was a member of the Board. The Board encourages, but does not require, its directors to attend the Company’s annual meeting. All then-current directors attended the 20162019 Annual Meeting of Stockholders.

As required by the listing standards of the NASDAQ Stock Market (“NASDAQ”), a majority of the members of the Board must qualify as “independent,” as affirmatively determined by the Board. Our board of directorsBoard determines director independence based on an analysis of such listing standards and all relevant securities and other laws and regulations regarding the definition of “independent.”

As a result of the Board’s review of the relationships of each of the Nominees for election todirectors that served on the Board during the year ended December 31, 2019, the Board has affirmatively determined that Messrs. Benz, Frawley, and Mathis, and Ms. Shattuck Kohn were “independent” directors within the meaning of the NASDAQ listing standards and applicable law.

As a majorityresult of the Board’s review of the relationships of each of its current directors (each a Nominee), the Board affirmatively determined that Messrs. Frawley and Nominees, Messrs. Benz, Fried, Mathis Rubin, and Swayman,Ms. Shattuck Kohn are “independent” directors within the meaning of the NASDAQ listing standards and applicable law.

Code of Ethics

The Company has adopted a Code of Ethics, which is applicable to the Company’s directors, officers, and employees, including the Company’s principal executive officer and principal financial officer. The Code of Ethics is published on the Company’s website atwww.cogint.comwww.fluentco.com on the Investor Relations page.Investors page under the corporate governance link. We will disclose on our website amendments to or waivers from our Code of Ethics on our website in accordance with all applicable laws and regulations.

Board Leadership Structure

The CompanyBoard does not currently have a Chairman. Mr. Schulke is led by Michael Brauser, who has served asour Chief Executive Officer and a directordirector. The Board is considering the possibility of the Company and our Executive Chairman since June 2015. The Executive Chairmanadding one or more additional Board members, one of whom it is the individual selected by the Board to manage our Company on a day to day basis. A number of factors support the leadership structure chosen by the Board, including, among others, that his direct involvement in our business operations makes him best positioned to lead productive Board strategic planning sessions and determine the time allocated to each agenda item in discussions of our Company’s short- and long-term objectives. Although we have no formal policycontemplated will take on the separationrole of our lead executive and chairman of the board, we believe that our current leadership structure is suitable for us. Five of our directors satisfy NASDAQ independence requirements. Our Board also includes two management directors other than Mr. Brauser. The Company does not have a member of our Board who is formally identified as the lead independent director, however Dr. Phillip Frost serves as our Vice Chairman. Also, independentIndependent directors head each of our Board’s three standing committees — the(the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee,Committee), and each of the committees is comprised solely of independent directors.

Board Oversight of Enterprise Risk

The Board’s role in the risk oversight process includes receiving regular reports from members of senior management on areas of material risk to the Company, including operational, financial, legal and regulatory, cybersecurity and

7

strategic and reputational risks. In connection with its reviews of the operations of the Company’s business and its corporate functions, the Board considers and addresses the primary risks associated with these operations and functions. Our full Board regularly engages in discussions of the most significant risks that the Company is facing and how these risks are being managed.

In addition, each of the Board’s committees, and particularly the Audit Committee, plays a role in overseeing risk management issues that fall within such committee’s areas of responsibility. Senior management reports on at least a quarterly basis to the Audit Committee on the most significant risks facing the Company from a financial reporting perspective and highlights any new risks that may have arisen since the Audit Committee last met. The Audit Committee also meets regularly in executive sessionsessions with the Company’s independent registered public accounting firm and reports any findings or issues to the full Board. In performing its functions, the Audit Committee and each standing committee of the Board has full access to management, as well as the ability to engage advisors. The Board receives regular reports from each of its standing committees regarding each committee’s particularized areas of focus.

Committees

The standing committees of the Board are the Audit Committee established in accordance with section 3(a)(58)(A) of the Exchange Act, the Compensation Committee, and the Corporate Governance and Nominating Committee.

Audit CommitteeCommittee.

The members of the Audit Committee areduring 2019 were Peter Benz (Chairman), Robert SwaymanAndrew Frawley, Donald Mathis and Donald Mathis,Barbara Shattuck Kohn, all of whom are independent directors as determined by the NASDAQ listing standards. Effective April 1, 2020, Mr. Benz resigned from the Company's Board. The Board has appointed Barbara Shattuck Kohn as the new Chairperson of the Audit Committee. The Board has determined that Mr. Benz is anand Ms. Shattuck Kohn are audit committee financial expertexperts as defined in Item 407(d)(5)(ii) of RegulationS-K. During 2019, the Audit Committee held five meetings and took no action by written consent.

The functions of the Audit Committee include retaining our independent registered public accounting firm, reviewing its independence, reviewing and approving the planned scope of our annual audit, reviewing and approving any fee arrangements with our independent registered public accounting firm, overseeing its audit work, reviewing and pre-approving any non-audit services that may be performed by our independent registered public accounting firm, reviewing the adequacy of accounting and financial controls, reviewing our critical accounting policies and reviewing and approving any related party transactions. Additional information regarding the Audit Committee is set forth in the Report of the Audit Committee below.

The Board has adopted a written charter for the Audit Committee which the Audit Committee reviews and reassesses for adequacy on an annual basis. A copy of the Audit Committee’s charter is located on our website atwww.cogint.comwww.fluentco.com. on the Investors page under the corporate governance link.

The Audit Committee held six meetings during 2016 and took no action by written consent.

Compensation CommitteeCommittee.

The members of the Compensation Committee are Steven Rubinduring 2019 were Donald Mathis (Chairman), Robert Fried, Peter Benz, Andrew Frawley and Donald Mathis,Barbara Shattuck Kohn, all of whom are independent directors as determined by the NASDAQ listing standards. The Compensation Committee is responsible for reviewing and approving compensation of the Company’s executive officers and for advising the Board with respect to compensation of the members of the Board or any committee thereof. During 2019, the Compensation Committee held five meetings and took five actions by written consent. The Board has affirmatively determined that each of Messers. Rubin, Fried, Benzadopted a written charter for the Compensation Committee and Mathis are independent pursuant to Rule 5605 of the NASDAQ listing standards.reassesses for adequacy on an annual basis. A copy of the Compensation Committee’s charter is located on our website atwww.cogint.comwww.fluentco.com. on the Investors page under the corporate governance link.

The Compensation Committee held six meetings during 2016seeks to ensure that the executive pay program reinforces the Company’s compensation philosophy and took no action by written consent.

aligns with the interests of our stockholders. The Compensation Committee Interlocksalso periodically monitors any potential risks associated with the Company’s compensation program and Insider Participationpolicies.

The members of our Compensation Committee duringis responsible for reviewing and approving all compensation of the year ended December 31, 2016 were Steven Rubin (Chairman), Robert Fried, Peter BenzCompany's executive officers and Donald Mathis. From November 2007for advising the Board with respect to October 2009, Mr. Fried servedany proposed changes in the compensation of Board members, including as Presidentto committee service, as well as retirement policies and Chief Executive Officer of Ideation. From June 2007programs and perquisites for directors. The Compensation Committee has the authority to October 2009, Mr. Rubin served as Secretary of Ideation. No member ofretain or terminate any consulting firm or other advisors used to assist the Compensation Committee is a current or former officer or employeein the performance of ours or anyits duties. In 2018, the Company retained the services of our subsidiaries. None ofPay Governance, LLC ("Pay Governance"), an independent compensation consultant. Pay Governance reports directly to the members of our Compensation Committee had any relationship requiredand communicates with our management team when appropriate. In addition, Pay Governance may seek feedback from the committee chairman and other Board members regarding its work before presenting study results or recommendations to the Compensation Committee. The compensation consultant may be disclosed under this caption underinvited to attend Compensation Committee meetings. In 2019, Pay Governance continued to provide advice related to executive compensation and peer group benchmarking and helped develop an equity incentive plan for the rulesCompany's senior management team. Specifically, Pay Governance's services during 2018 and into 2019 included help with several important objectives, including (i) determining competitive pay levels to assess how competitively executives are being paid for their current responsibilities, particularly in the context of the Securitiesa public company and Exchange Commission (the “SEC”).

8

Corporate Governance and Nominating Committee

The members of the Corporate Governance and Nominating Committee during 2019 were Andrew Frawley (Chairman), Peter Benz, Donald Mathis and Barbara Shattuck Kohn, all of whom are Robert Fried, Steven Rubinindependent directors determined by the NASDAQ listing standards. The Corporate Governance and Peter Benz. The Nominating Committee is responsible for identifying individuals qualified to become members of the Board or any committee thereof; recommending nominees for election as directors at each annual stockholder meeting; recommending candidates to fill any vacancies on the Board or any committee thereof; and overseeing the evaluation of the Board. During 2019, the Corporate Governance and Nominating Committee held three meetings and took one action by written consent. The Board has adopted a written charter for the Corporate Governance and Nominating Committee. A copy of the Corporate Governance and Nominating Committee’s charter is located on our website atwww.cogint.comwww.fluentco.com. on the Investors page under the corporate governance link.

In evaluating director candidates, the Chair of the Nominating and Corporate Governance Committee and other committee members may conduct interviews with certain candidates and make recommendations to the committee. Other members of our Board may also conduct interviews with director candidates upon request, and the Nominating and Corporate Governance Committee may retain, at its discretion, third-party consultants to assess the skills and qualifications of the candidates. Although our Board of Directors does not have a specific policy with respect to diversity, the Nominating and Corporate Governance Committee considers the extent to which potential candidates possess sufficiently diverse skill sets and diversity characteristics that would contribute to the overall effectiveness of our Board of Directors.

In identifying potential director candidates, the Nominating and Corporate Governance Committee seeks input from other members of our Board and executive officers and may also consider recommendations by employees, community leaders, business contacts, third-party search firms and any other sources deemed appropriate by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee will also consider director candidates recommended by other stockholders to stand for election at the Annual Meeting of Stockholders so long as such recommendations are submitted in accordance with the procedures described below. The Nominating and Corporate Governance Committee has not had any director candidates put forward by a stockholder or a group of stockholders that beneficially owned more than five percent of our common stock for at least one year.

The Nominating and Corporate Governance Committee held no meetings during 2016will evaluate candidates recommended by stockholders in the same manner as all other candidates brought to the attention of the Nominating and took action by written consent one time.Corporate Governance Committee. See “Nominees for Director and Other Stockholder Proposals” below.

Communications with our Board of Directors

Any stockholder who wishes to send a communication to our Board should address the communication either to the Board or to the individual director in care of Joshua Weingard,Daniel Barsky, General Counsel and Corporate CounselSecretary of Cogint,Fluent, Inc. at 2650 North Military Trail, Suite 300 Boca Raton, Florida 33431.Vesey Street, 9th Floor, New York, New York 10282. Mr. WeingardBarsky will forward the communication either to all of the directors, if the communication is addressed to the Board, or to the individual director, if the communication is addressed to a specific director. Mr. Barsky will forward to the directors all communications that, in his or her judgment, are appropriate for consideration by the directors. Examples of communications that would not be appropriate for consideration by the directors include commercial solicitations and matters not relevant to the stockholders, to the functioning of the Board, or to the affairs of Fluent.

Nominees for Director and Other Stockholder Proposals

Stockholder proposals intended to be presented at our 2021 annual meeting of stockholders must be received by our Corporate Secretary at 300 Vesey Street, 9th Floor, New York, New York 10282 not later than December 31, 2020, to be considered for inclusion in our proxy materials, pursuant to Rule 14a-8 under the Exchange Act.

The Corporate Governance and Nominating Committee will consider all qualified director candidates identified by various sources, including members of the Board, management and stockholders. Candidates for directors recommended by stockholders will be given the same consideration as those identified from other sources. The Corporate Governance and Nominating Committee is responsible for reviewing each candidate’s biographical information and assessing each candidate’s independence, skills, qualifications, and expertise based on a number of factors. While we do not have a formal policy on diversity, when considering the selection of director nominees, the Corporate Governance and Nominating Committee considers individuals with diverse backgrounds,experience, viewpoints, accomplishments, cultural backgrounds, and professional expertise, among other factors.and backgrounds, including both gender and ethnic diversity and diversity in substantive matters pertaining to the Company's business.

Only persons who are nominated in accordance with the procedures set forth in our bylawsBylaws will be eligible for election as directors. Nominations of persons for election to the Board and other proposals presented to our stockholders may be made at a meeting of stockholders at which directors are to be elected only (i) by or at the direction of the Board or (ii) by any stockholder of the Company entitled to vote for the election of directors at the meeting who complies with the notice procedures set forth in our bylaws.Bylaws. Such nominations and other proposals presented to our stockholders, other than those made by or at the direction of the Board, shall be made by timely notice in writing to the Corporate Secretary of the Company. To be timely, a stockholder’s nomination for a director or other stockholder proposal must be delivered to the Corporate Secretary at the Company’s principal executive offices notno later than the close of business on the ninetieth (90th)(90th) day, nor earlier than the close of business on the one hundred twentieth (120th )(120th) day, before the first anniversary of the preceding year’s annual meeting. The stockholder’s notice shall set forth as to each person whom the stockholder proposes to nominate for election as a director: (i) all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or all information that is required in connection with a stockholder proposal, in each case pursuant to and in accordance with the Section 14(a) of the Securities Exchange Act of 1934, as amended and the rules and regulations promulgated thereunder, and (ii) such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected.

Messrs. Schulke Pursuant to our Bylaw requirements and Mathis have been nominated to the Board in accordance with the Stockholders’ Agreement entered into in connection with the Fluent Acquisition, which provides in partassuming that beginning with the firstour 2021 annual meeting of stockholders followingis held on June 2, 2021, any stockholder proposal to be considered at the closing2021 annual meeting, including nominations of the Fluent Acquisition and thereafterpersons for so long as the Fluent stockholders beneficially own, in the aggregate, at least 30%election to our board of the shares issued in the Fluent Acquisition, Sellers are entitleddirectors, must be properly submitted to nominate two individuals to the Board.us not earlier than February 2, 2021, nor later than March 4, 2021.

PROPOSAL 2

9

RATIFICATION OF THE APPOINTMENT OF GRANT THORNTON LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR 2020

Grant Thornton LLP (“Grant Thornton”) currently serves as the Company’s independent registered public accounting firm. Grant Thorntonfirm and has acted in such capacitydone so since its appointment effective July 14, 2015. A representative of Grant Thornton is expected to be present at the Meeting, with the opportunity to make a statement if the representative desires to do so, and is expected to be available to respond to appropriate questions.

Changes in Independent Registered Public Accounting

Effective July 14, 2015,We are asking our stockholders to ratify the Committee appointedappointment of Grant Thornton as the Company’s principalour independent registered public accountant to audit the Company’s consolidated financial statementsaccounting firm for the fiscal year endedending December 31, 2015. In connection with2020. Although ratification is not required by our Bylaws or otherwise, our Board is submitting the appointment of Grant Thornton to our stockholders for ratification as a matter of good corporate governance. If our stockholders fail to ratify the appointment of Grant Thornton, the Audit Committee dismissed RBSM LLP (“RBSM”) effective July 14, 2015, as the Company’swill consider whether it is appropriate and advisable to appoint a different independent registered public accountants. RBSM had servedaccounting firm. Even if our stockholders ratify the appointment of Grant Thornton, the Audit Committee in its discretion may appoint a different registered public accounting firm at any time if it determines that such a change would be in the best interests of our Company and our stockholders.

Vote Required and Board Recommendation:

Proposal 2 requires the affirmative vote of the holders of a majority in voting power of the shares of common stock which are present in person or by proxy at the Meeting and entitled to vote.

The Board recommends that you vote “FOR” the ratification of the appointment of Grant Thornton as the Company’sour independent registered public accountant since its engagement on May 14, 2015. RBSM did not issue a report on the Company’s financial statementsaccounting firm for the year endedending December 31, 2015.2020.

During the period May 14, 2015 through July 14, 2015, the Company had not had any disagreements with RBSM on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to RBSM’s satisfaction, would have caused them to make reference thereto in their reports on the Company’s financial statements for such periods. During the period May 14, 2015 through July 14, 2015, there were no reportable events, as defined in Item 304(a)(1)(v) of RegulationS-K.

On May 14, 2015, the Committee appointed RBSM as the Company’s principal independent registered public accountant to audit the Company’s consolidated financial statements for the fiscal year ended December 31, 2015. This action effectively dismissed Marcum Bernstein & Pinchuk LLP (“MBP”) as of May 14, 2015, as the Company’s principal independent registered public accountants.

The audit report of MBP on the financial statements of the Company, as of and for the years ended December 31, 2014 and December 31, 2013, did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the years ended December 31, 2014 and 2013, there were no disagreements with MBP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which if not resolved to MBP’s satisfaction would have caused it to make reference thereto in connection with its reports on the financial statements for such years. During the years ended December 31, 2014 and 2013 and through May 14, 2015, there were no reportable events of the type described in Item 304(a)(1)(v) of RegulationS-K.

Previously, the consolidated financial statements of Company subsidiary IDI Holdings, LLC (“IDI Holdings”), formerly The Best One, Inc., for the year ended December 31, 2014 (the “2014 Financials”) were audited by L.L. Bradford & Company, LLP (“LLB”); however, LLB is no longer PCAOB registered and, as a result, the Company can no longer include LLB’s audit opinion with the Company’s filings. As a result, on March 15, 2016, the Committee appointed RBSM for the sole purpose of auditing IDI Holdings’ 2014 Financials.

Auditor Fees Andand Services

The following table sets forth the fees billed to the Company by the Company’s independent registered public accountants, Grant Thornton, for the years ended December 31, 20162019 and December 31, 2015.2018.

| 2016 | 2015 | |||||||

Audit Fees | $ | 837,096 | $ | 595,481 | ||||

Audit-Related Fees | 80,763 | 34,556 | ||||||

Tax Fees | — | 8,697 | ||||||

All Other Fees | — | — | ||||||

|

|

|

| |||||

Total | $ | 917,859 | $ | 638,734 | ||||

2019 | 2018 | |||||

Audit Fees | $ | 861,429 | $ | 827,864 | ||

Audit-Related Fees | — | — | ||||

Tax Fees | — | — | ||||

All Other Fees | — | — | ||||

Total | $ | 861,429 | $ | 827,864 | ||

10

Audit fees consist of fees billed for professional services rendered for the audit of our consolidated annual financial statements, and internal control over financial reporting, the review of the interim consolidated financial statements included in quarterly reports and the fees for services such as comfort letters, consents and review of documents filed with the SEC that are normally provided in connection with statutory and regulatory filings for engagements. In 2015, audit fees billed by RBSM of $40,000 were also included.

Audit-related fees are fees billed for assurance and related services rendered by Grant Thornton that are not reported under audit fees, such as accounting consultations and audits in connection with acquisitions.

Tax fees in 2015 relates to tax consulting services performed by Grant Thornton prior to being engaged as the Company’s independent registered public accountant.

Pre-Approval Policies and Procedures for Audit and PermittedNon-Audit Services

The Audit Committee is responsible forpre-approving all auditing services and permittednon-audit services (including the fees for such services and terms thereof) to be performed for the Company by its independent registered public accounting firm. The Audit Committee is also responsible for considering whether the independent registered public accounting firm’s performance of permissiblenon-audit services is compatible with its independence. The Audit Committee chairman has authority to grantpre-approvals of audit and permissiblenon-audit services by the independent registered public accounting firm provided that allpre-approvals by the chairman must be presented to the full Audit Committee at its next scheduled meeting. Consistent with these policies and procedures, the Audit Committee approved all of the services rendered by the applicable auditors for the years endedending on December 31, 20162019 and December 31, 2015,2018, as described above.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board. Management has the primary responsibility for establishing and maintaining adequate internal control over financial reporting, for preparing the financial statements and for the report process. The Audit Committee members do not serve as professional accountants or auditors, and their functions are not intended to duplicate or to certify the activities of management or the independent registered public accounting firm. We have engaged Grant Thornton as our independent public accountants to report on the conformity of the Company’s financial statements to accounting principles generally accepted in the United States. In this context, the Audit Committee hereby reports as follows:

1. | The Audit Committee has reviewed and discussed the audited financial statements with management of the Company. |

2. | The Audit Committee has discussed with Grant Thornton, our independent registered public accounting firm, the matters required to be discussed by Public Company Accounting Oversight Board Auditing Standard No. 1301,Communications with Audit Committees. |

3. | The Audit Committee has also received the written disclosures and the letter from Grant Thornton required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence and the Audit Committee has discussed the independence of Grant Thornton with that firm. |

4. | Based on the review and discussion referred to in paragraphs (1) through (3) above, the Audit Committee recommended to the Board and the Board approved the inclusion of the audited financial statements in the Company’s Annual Report on Form10-K for the fiscal year ended December 31, |

The foregoing has been furnished by the Audit Committee:

Peter Benz (Chairman)Barbara Shattuck Kohn (Chair)

Robert SwaymanAndrew Frawley

Donald Mathis

11

This “Audit Committee Report” is not “Soliciting Material,” and is not deemed filed with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

EXECUTIVE COMPENSATION

COMPENSATION COMMITTEE REPORTMANAGEMENT

Executive Officers

The following statement made bytable sets forth certain information with respect to our Compensation Committee does not constitute soliciting materialcurrent executive officers.

Name | Age | Position | ||

Ryan Schulke | 37 | Chief Executive Officer | ||

Matthew Conlin | 36 | President | ||

Alexander Mandel | 50 | Chief Financial Officer | ||

Donald Patrick | 59 | Chief Operating Officer |

The biographical information for Messrs. Schulke and should not be deemed filed or incorporated by reference into any filing under the Securities ActConlin is included above in Proposal 1 — Election of 1933,Directors.

Alexander Mandel was appointed as amended, or the Securities Exchange ActChief Financial Officer, effective as of 1934,February 1, 2019, prior to which he had been serving as amended, exceptan independent financial consultant to the extent that we specifically incorporate such statement by reference.

Cogint’s Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis required by Item 402(b) of RegulationS-K and, based on such review and discussion, the Compensation Committee recommendedCompany since July 2018. From February 2016 to the Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement and incorporated by reference in the Company’s Annual Report on Form10-K for the fiscal year ended December 31, 2016.

Compensation Committee:

Steven D. Rubin — Chairman

Robert Fried

Peter Benz

Donald Mathis

COMPENSATION DISCUSSION AND ANALYSIS

Overview

This discussion and analysis describes the material elements of compensation awarded to, earned by, or paid to the named executive officers of the Company during 2016, and provides a brief summary of the compensation to be paid to the executive officers in 2017. Throughout this analysis, the individuals whoJune 2018, Mr. Mandel served as the Chief ExecutiveFinancial Officer andof IAC Applications, a division of IAC/InterActiveCorp. From 2010 to 2015, Mr. Mandel was employed by LendingTree, Inc., including as its Chief Financial Officer during 2016,from 2012 to 2015. He was a Managing Director at Centerview Partners LLC, an investment banking advisory firm in New York City, from 2008 to 2010. Prior to that, Mr. Mandel held various positions at investment banking firm Bear, Stearns & Co. Inc. from 1996 to 2008, including Managing Director beginning in 2003. He received his Bachelor of Arts in economics from Tufts University and his Masters of Business Administration from Columbia Business School.

Donald Patrick was appointed the Company’s Chief Operating Officer as wellof March 26, 2018. Mr. Patrick joined Fluent, LLC as other individuals includedits Chief Operating Officer in the Summary Compensation Table and other tables below, are referred to as the “named executive officers.”

Background. During 2014 and before the March 21, 2015 merger (“TBO Merger”) between Tiger Media, Inc. (“Tiger Media”) and The Best One, Inc. (“TBO”), Tiger Media was engaged in the outdoor advertising business in China. Before the TBO Merger, Peter W.H. TanJanuary 2018. Mr. Patrick served as Chief Executive Officer of Tiger Media and following the TBO Merger, whereby TBO becameSeneca One Finance, Inc., a wholly-owned subsidiary of the Company, Derek Dubner joined Peter Tan asCo-Chief Executive Officers of the Company. Jacky Wang joined Tiger Media as Chief Financial Officer on August 1, 2014. Before Mr. Wang, duringspecialty consumer finance company, from 2014 Peter Tanto 2017. From 2011 to 2013, he served as Interim Chief Financial Officer. Tiger Media changed its name to IDI,President of Infogroup Marketing Services, a business unit of InfoGROUP, Inc. in April 2015. Company subsidiary TBO changed its name to IDI Holdings in March 2015. In June 2015, in connection with the continuing shift in the Company’s focus towards the big data and analytics sector via subsidiary Interactive Data, the Company’s Board approved a plan to discontinue the operations of its Chinese- and British Virgin Islands-based subsidiaries. None of the executives serving the Company during 2014 and through completion of the TBO MergerBefore that, Mr. Patrick served as a named executive officer during 2016 and as such neither this discussion nor the tables that follow include 2014 information.

12